JobKeeper extension

25.09.2020

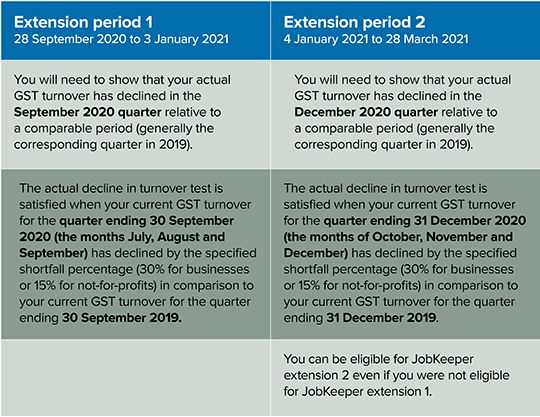

The JobKeeper scheme has been extended from 28 September 2020 until 28 March 2021. There are two separate extension periods:

- Extension 1: from 28 September 2020 to 3 January 2021

- Extension 2: from 4 January 2021 to 28 March 2021

For each extension period, an additional actual decline in turnover test applies and the rate of the JobKeeper payment is different.

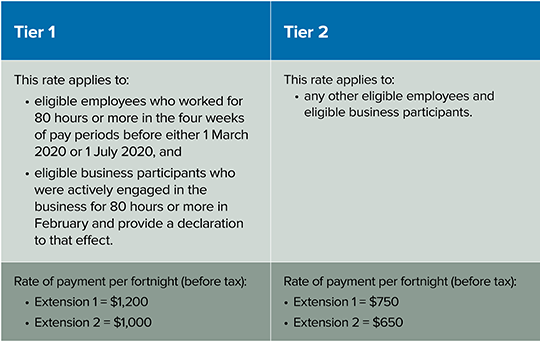

Changes to rates of payment

JobKeeper payment rates will depend on the number of hours:

- an eligible employee works, or

- an eligible business participant is actively engaged in the business.

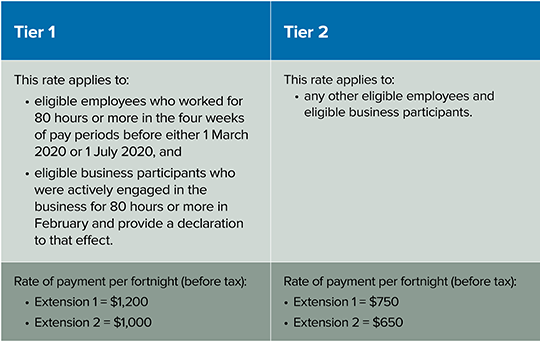

The rate will be split into two tiers for each extension period:

Employers and businesses will need to nominate the rate they are claiming for each eligible employee and/or eligible business participant.

Alternative tests for determining the payment rates that apply to an eligible employee, eligible business participant or eligible religious practitioner may be available in some circumstances. We will provide further advice when the ATO publishes further guidance.

Eligibility

To be eligible for the Job keeper extension periods, businesses will need to re-test their turnover for both extension periods.

Unlike when you calculated the original decline in turnover test, you do not use your projected GST turnover for the relevant quarter being tested. You use your current GST turnover.

To work out which supplies you have made in the turnover test period, you must use the accounting basis you used for GST reporting purposes. Depending on your circumstances, you could use a cash basis or a non-cash basis.

A GST accounting basis will apply to allocate supplies to a test period regardless of whether:

- the supply was a taxable supply, or

- you report GST on a monthly or quarterly basis.

For many businesses registered for GST, this calculation will match the ‘total sales’ reported at G1 on your BAS minus GST payable (1A), where applicable.

If you are not registered for GST, you will work out your turnover using either the GST cash or non-cash basis of accounting.

You can provide additional turnover information to demonstrate that you satisfy the actual decline in turnover test for the September quarter from the start of October onwards. You must provide it before you complete your November monthly declaration.

Alternative tests for determining actual decline in turnover may be available in some circumstances. These will apply in a similar way to the alternative tests for the original decline in turnover test. However, they must be applied on the basis that the turnover test period is a quarter. We will provide more information on the alternative tests for the actual decline in turnover test once it is available.

You also need to have satisfied the original decline in turnover test. However, if you:

- were entitled to receive JobKeeper for fortnights before 28 September, you have already satisfied the original decline in turnover test

- are enrolling in JobKeeper for the first time from 28 September 2020, if you satisfy the actual decline in turnover test, you will also satisfy the original decline in turnover test (except for certain universities). You can enrol on that basis.

Key dates and actions for employers!

From 28 September 2020:

- JobKeeper extension 1 starts on 28 September, and the payment rates will change for your eligible employees.

- Work out if the tier 1 or tier 2 rate applies to each of your eligible employees.

- Notify the ATO and your eligible employees which payment rate applies to them.

Between 1 and 14 October 2020:

- Complete the October JobKeeper monthly business declaration so you can be reimbursed for September fortnights.

Between 1 and 31 October 2020:

- Check and submit to the ATO, the business actual decline in turnover to be eligible for JobKeeper extension 1.

31 October 2020:

- For the JobKeeper fortnights from 28 September 2020 and 12 October 2020 only, the ATO are allowing employers until 31 October 2020 to meet the wage condition.

Between 1 and 14 November:

- Complete a monthly business declaration and advise the ATO of the payment tier being claimed for each eligible employee.

From 28 September 2020 to 3 January 2021 (JobKeeper extension 1):

- Ensure your eligible employees are paid at least:

- $1,200 per fortnight for tier 1 employees

- $750 per fortnight for tier 2 employees

From 4 January 2021 to 28 March 2021 (JobKeeper extension 2):

- Ensure your eligible employees are paid at least:

- $1,000 per fortnight for tier 1 employees

- $650 per fortnight for tier 2 employees

What’s staying the same

To claim for fortnights in the JobKeeper extension 1 or 2:

- You don’t need to re-enrol for the JobKeeper extension if you are already enrolled – but note you do need to confirm eligibility.

- You don’t need to reassess employee eligibility, or ask employees to agree to be nominated by you as their eligible employer, if you are already claiming for them before 28 September.

- You don’t need to meet any further requirements if you are claiming for an eligible business participant, other than those that applied from the start of JobKeeper.

Important Updates to Job Keeper 1.0 & 2.0

18.08.2020

Announcements made on Friday 14th August mean we now need to revisit JobKeeper 1.0 to ensure your business stays eligible and to maximise your JobKeeper entitlements. The government has also announced a relaxation of the eligibility criteria for JobKeeper 2.0.

New 1 July 2020 eligibility date

The date for assessing eligible employees has changed (effective from 3 August 2020) from 1 March 2020 to 1 July 2020. This means you may now have more eligible employees who you can receive JobKeeper payments for.

This change will particularly affect the following groups of employees:

- Any new employees as at 1 July 2020 who were not employed as at 1 March 2020 (full-time, part-time or fixed-term employees).

- Any long-term casual employees who meet the 12-month test between 1 March 2020 and 1 July 2020 (employees still also need to be employed on a regular and systematic basis and not a permanent employee of any other employer).

- Any employees who turned 18 years of age between 1 March 2020 and 1 July 2020 (if employees were 16 or 17 they can still qualify if considered ‘independent’ or not undertaking full time study).

- Any employees who, between 1 March 2020 and 1 July 2020, became an Australian resident under the Social Security Act definition.

- Any employees who, between 1 March 2020 and 1 July 2020, became an Australian resident for income tax purposes and who also hold a Subclass 444 (Special Category) visa.

One in, all in rule

If you have any employees who meet the new eligibility requirements as at 1 July 2020, you MUST now add them to your JobKeeper declarations to remain eligible for any JobKeeper payments.

Under the one-in, all-in rule you must provide JobKeeper to all employees that meet the requirements and have provided the necessary nomination forms.

Turnover test

Please note that the above changes DO NOT require you to retest the required drop in turnover. If you currently qualify for JobKeeper, you will continue to qualify until 28 September with this round of changes, you just need to update to include any newly eligible employees.

3-fortnight period

Remember August is a 3-fortnight period for JobKeeper purposes and not a typical 2-fortnight period. This means you need to have paid your employees at least $4,500 rather than the usual $3,000.

New nomination forms

If you have any newly eligible employees (as detailed above), you need to get them to complete a nomination form as soon as possible to acknowledge JobKeeper is being claimed by the employer and that they are not claiming JobKeeper from any other employer.

> Access the new nomination form here

Actions required!

Any businesses currently eligible for JobKeeper (or which may have become eligible after 3 August 2020) must now do the following:

- Review whether you have any newly eligible employees

- Provide all newly eligible employees with the new nomination formand have them complete and return the form to you

- Check you have paid the minimum amount to all employees, including the newly eligible employees, and make top-up payments where necessary by 31 August 2020 (this could be as much as $4,500 for the month)

- Include newly eligible employees within your monthly declaration for August fortnights (which are due 14 September 2020)

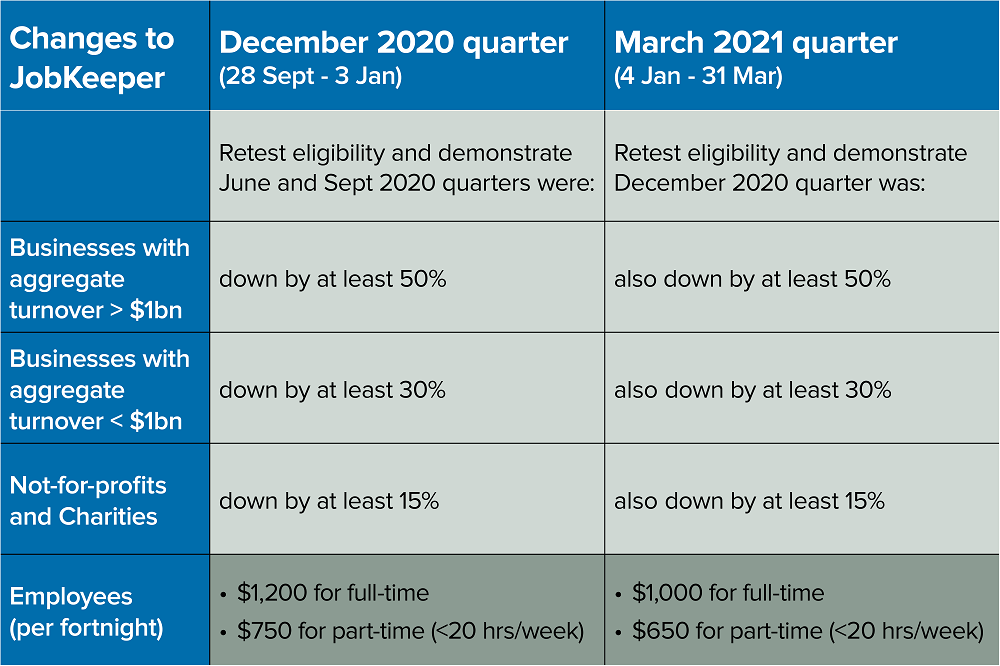

Changes to JobKeeper 2.0 eligibility

As flagged in our previous newsletter (6 August, COVID-19 Important Updates), the Treasurer has announced an easing of JobKeeper 2.0 eligibility, whereby businesses will only need to show that their GST turnover had fallen in the September quarter to qualify for the scheme’s first extension. The original announcement required that the business turnover had fallen in both the June and September quarters.

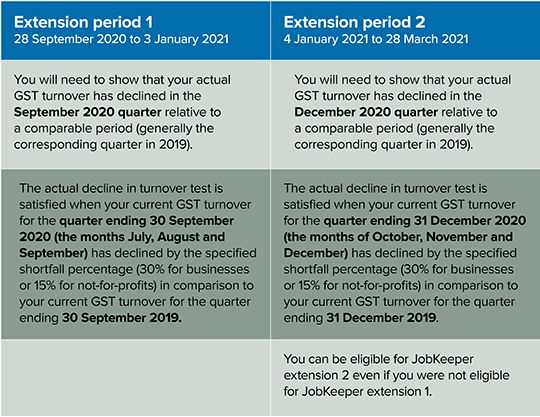

- Based on the revised announcement, in order to be eligible for the first JobKeeper Payment extension period of 28 September 2020 to 3 January 2021, businesses will need to demonstrate that their actual GST turnover has fallen in the September quarter relative to a comparable period (generally the corresponding quarter in 2019).

- To be eligible for the second JobKeeper Payment extension period of 4 January 2021 to 28 March 2021, businesses will need to demonstrate that their actual GST turnover has fallen in the December quarter 2020 relative to a comparable period (generally the corresponding quarters in 2019).

- Under the new rules, businesses have easier access to the extension, but the payment rate will drop as planned from $1,500 to $1,200. The $750 flat rate for employees working less than 20 hours per week will also proceed as previously announced.

- In addition, from 3 August 2020, the relevant date of employment will move from 1 March to 1 July 2020, increasing employee eligibility for the existing scheme and the extension.

> Get more information about JobKeeper changes from 14 August 2020

JobKeeper 2.0

05.08.2020

Job Keeper 2.0 has been released, but developments in Victoria over recent days may result in further changes being made.

Currently announced details of JobKeeper 2.0 mean that payments will be extended beyond 27 September 2020, but at reduced rates. There will also be tighter eligibility requirements for businesses and not-for-profits to receive the subsidy.

- JobKeeper will be extended until 28 March 2021

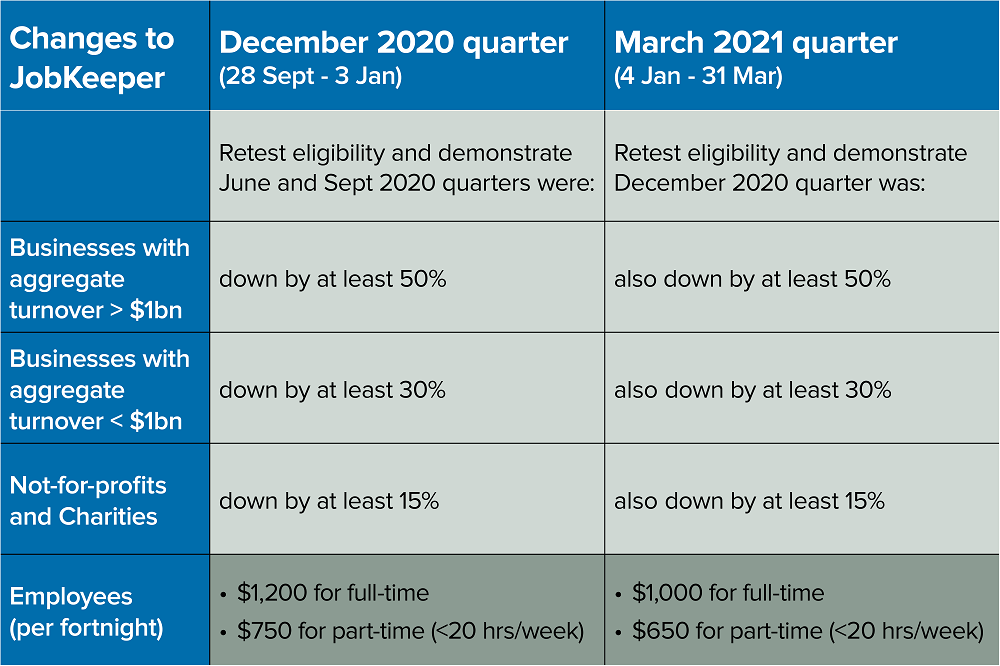

- Allowances for full-time workers will fall from $1,500 per fortnight, to:

- $1,200 per fortnight from 28 September 2020

- $1,000 per fortnight from 4 January 2021

- Allowances for part-time workers (< 20 hours per week) will fall from $1,500 per fortnight, to:

- $750 per fortnight from 20 September 2020

- $650 per fortnight from 4 January 2021

- To re-qualify for JobKeeper subsidies, businesses and not-for-profits will need to re-test their GST turnover prior to lodgement of their September and December quarter Business Activity Statements (BAS)

What does it mean for employers and employees?

From 28 September 2020, businesses and not-for-profits seeking to claim the JobKeeper Payment will need to demonstrate that they have suffered an ongoing significant decline in turnover (based on the June, September and December 2020 quarters) using actual GST turnover (rather than projected GST turnover). The table below provides an overview of the changes for each remaining quarter of the JobKeeper subsidy:

> JobKeeper Payment for employers and employees, including eligibility and how to enrol.

What does it mean for sole traders and other entities?

- Sole traders and some other entities (such as partnerships, trusts or companies) may be entitled to the JobKeeper Payment scheme under the business participation entitlement.

> JobKeeper Payment for sole traders and other entities, including eligibility and how to enrol.